Many Canadians wonder: is drug rehab tax deductible in Canada? The answer is yes, but specific rules apply.

We at Amity Palm Beach understand the financial burden of seeking treatment. The Canada Revenue Agency allows certain addiction treatment costs as medical expense tax credits, potentially reducing your tax bill significantly.

Understanding these deductions can make quality care more affordable for you and your family.

What Drug Rehab Expenses Can You Actually Deduct?

The Canada Revenue Agency recognizes drug and alcohol addiction as legitimate medical conditions. This classification makes related treatment expenses eligible for the Medical Expense Tax Credit. For 2024, you can claim medical expenses that exceed 3% of your net income or $2,479 (whichever is lower).

This threshold means if you earn $50,000 annually, you can only claim expenses above $1,500. The CRA requires that all claimed expenses be prescribed by a licensed healthcare provider and paid without insurance reimbursement.

Inpatient Treatment and Facility Costs

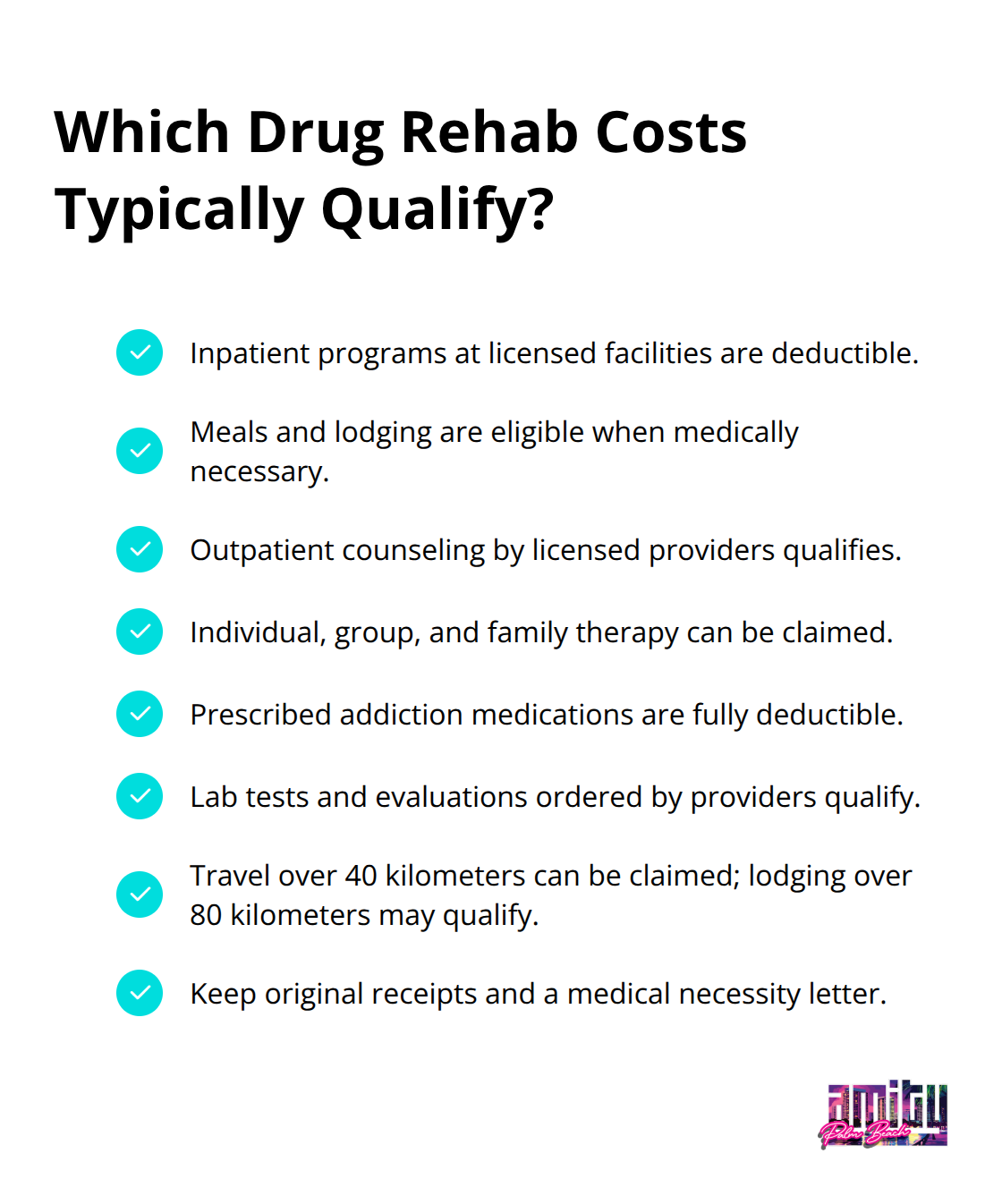

Inpatient rehabilitation programs at licensed facilities qualify for full deduction. This includes meals and lodging when medically necessary. The CRA considers these costs essential components of comprehensive addiction treatment. Licensed therapeutic centers must provide proper documentation to support your claims.

Outpatient Services and Professional Fees

Outpatient counseling sessions with registered psychologists or licensed therapists count toward your claim. Individual therapy, group sessions, and family counseling all qualify when prescribed by healthcare providers. Professional fees for psychiatric consultations and addiction medicine specialists also meet eligibility requirements.

Medications and Medical Procedures

Prescribed medications for addiction treatment receive full deductible status. This includes methadone, buprenorphine, and other medication-assisted treatments. Laboratory tests, medical assessments, and psychological evaluations ordered by healthcare providers all count as eligible expenses. Over-the-counter medications do not qualify unless specifically prescribed.

Travel and Accommodation Expenses

Travel expenses become claimable when you travel more than 40 kilometers for treatment. Lodging costs qualify if you travel over 80 kilometers to access care. The CRA allows reasonable transportation costs including gas, public transit, and taxi fares. Meal expenses during medical travel may also qualify under specific circumstances.

Documentation Requirements

The CRA conducts audits and will request proof of all claimed expenses. Keep every receipt and obtain a letter from your healthcare provider confirming the medical necessity of treatment. Your documentation must show the date of service, amount paid, and the licensed provider’s credentials. Payment records must demonstrate you paid these costs personally without insurance coverage or employer reimbursement.

Understanding these deduction categories helps you maximize your tax benefits while pursuing recovery. The next step involves learning how to properly file these claims on your tax return.

How Do You File Drug Rehab Expenses on Your Taxes?

You file drug rehab expenses by completing Form T1 with Schedule 1 for your Medical Expense Tax Credit claim. The CRA processes these claims through line 33099 on your tax return, where you report the total eligible expenses minus the threshold amount. You must file within the standard tax deadline of April 30th, though you can amend previous returns up to 10 years later if you missed eligible expenses. The process involves first calculation of your threshold, then subtraction of this from your total qualified expenses to determine your claimable amount.

Calculate Your Threshold and Maximum Benefits

Your medical expense threshold equals 3% of your net income or $2,479 for 2024 (whichever amount is lower). If your net income reaches a certain level or higher, you use the fixed threshold amount.

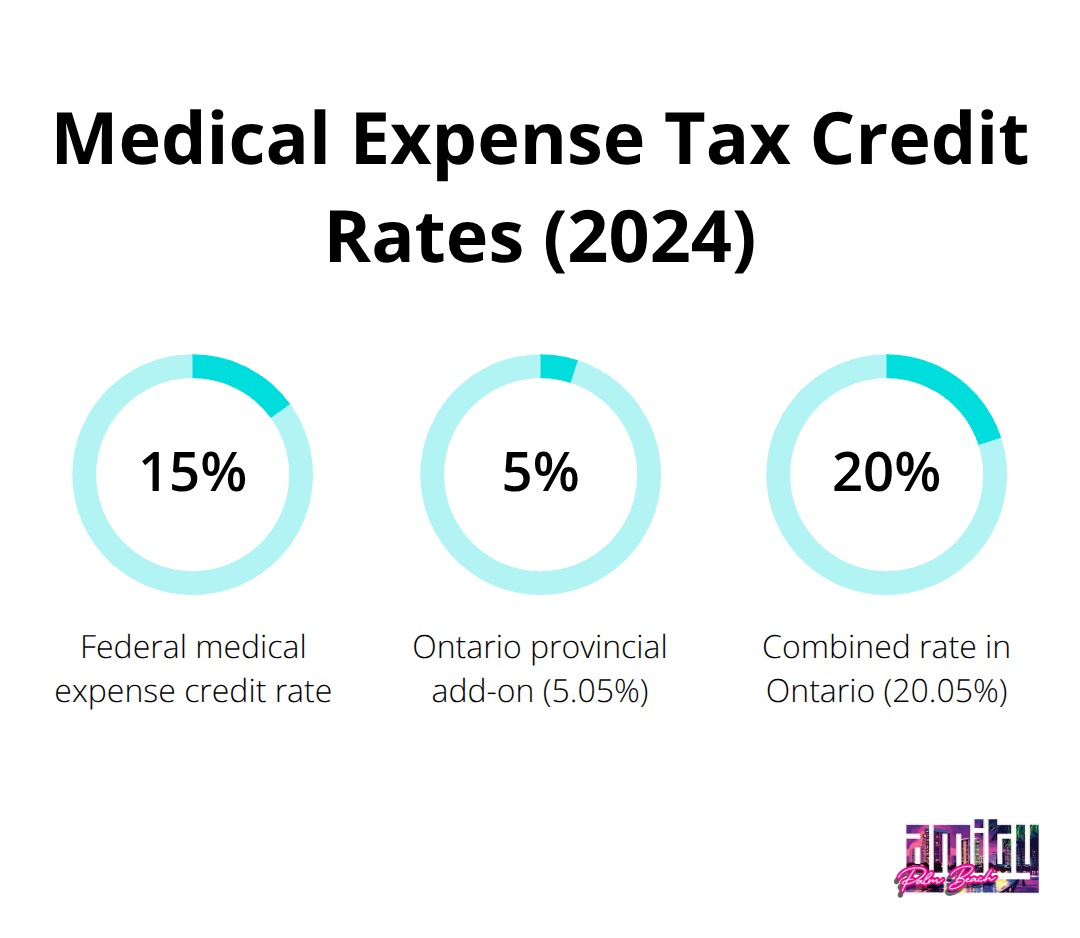

The maximum credit rate applies at 15% federally, plus your provincial rate. Ontario residents get an additional 5.05%, which makes their total credit rate 20.05%. This means every dollar above your threshold saves you approximately 20 cents in taxes in Ontario. Higher earners in provinces like Nova Scotia can see credit rates that exceed 25%.

Organize Documentation Before Tax Season

Create separate folders for receipts, prescription records, and healthcare provider letters before tax season starts. The CRA requires original receipts that show the date of service, amount paid, and provider credentials. Your healthcare provider must write a letter that confirms the medical necessity of treatment and their professional license information. Keep insurance statements that prove you received no reimbursement for claimed expenses. Missing documentation triggers automatic audit requests (which delay refunds by 6-12 months according to CRA statistics).

Submit Your Claim and Track Progress

Complete line 33099 on Schedule 1 with your calculated claimable amount after you subtract the threshold from total expenses. The CRA typically processes medical expense claims within 2-4 weeks for electronic filings and 6-8 weeks for paper returns. You can track your refund status through the CRA’s online portal or mobile app. The agency may request additional documentation during review, so keep all original receipts accessible for at least six years after submission.

While tax deductions help offset treatment costs, many Canadians need additional financial support to access quality addiction treatment.

What Other Funding Sources Cover Treatment Costs?

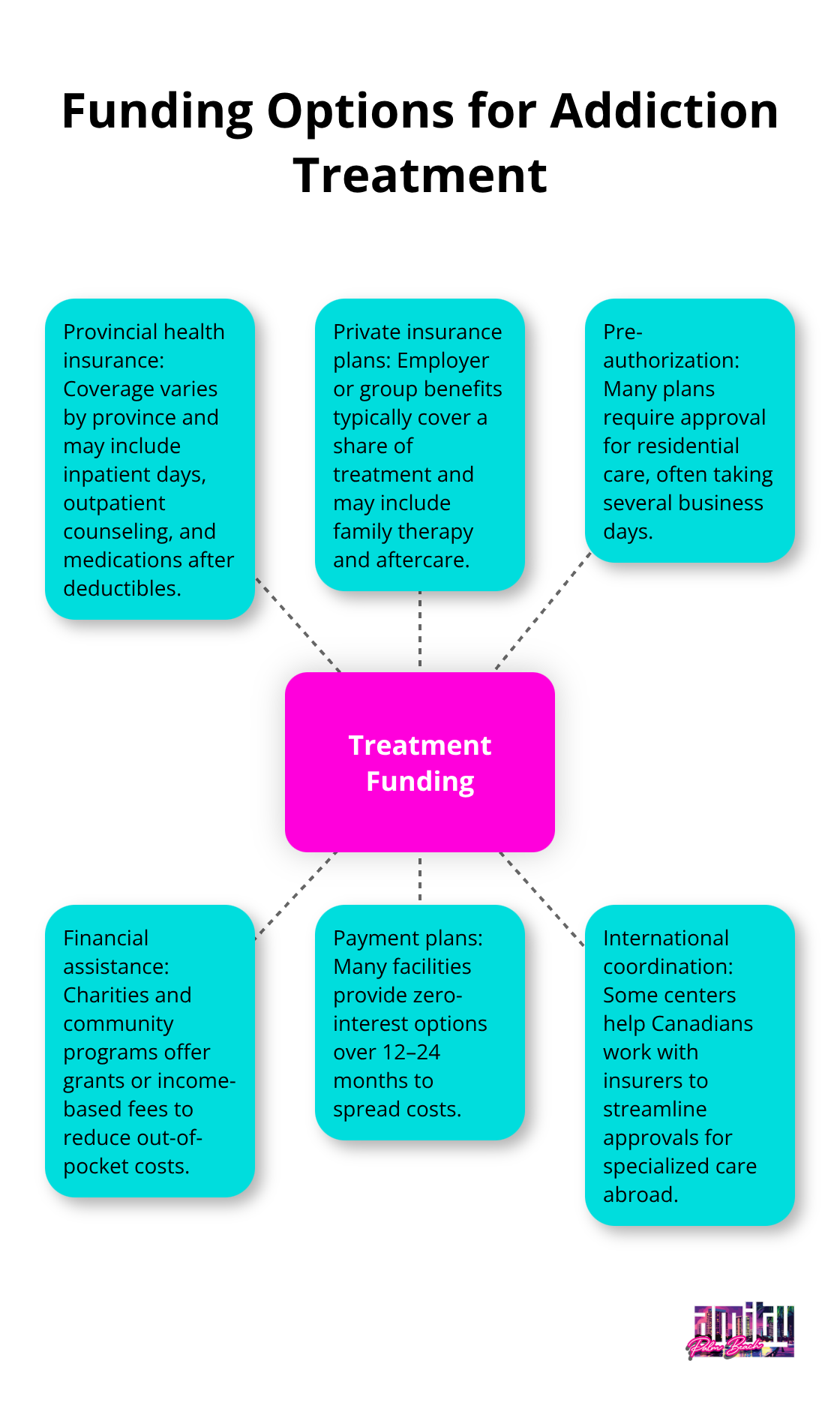

Provincial health insurance covers medically necessary addiction treatment services, but coverage varies dramatically across Canada. Alberta Health covers up to 28 days of residential treatment at approved facilities, while Ontario’s OHIP only covers detoxification and outpatient counseling services. British Columbia provides the most comprehensive coverage through its PharmaCare program (covering medication-assisted treatments like methadone and buprenorphine at 100% after deductibles). Saskatchewan residents can access up to 21 days of inpatient treatment through provincial funding, but waiting lists often stretch 3-6 months according to the Canadian Centre on Substance Use and Addiction.

Private Insurance Plans Fill Critical Gaps

Extended health benefits through employers typically cover 80% of addiction treatment costs up to annual maximums. Manulife and Sun Life policies generally provide better addiction coverage than smaller insurers, often including family therapy sessions and aftercare support. Many plans require pre-authorization for residential treatment (which takes 5-10 business days to process). Group benefits through professional associations like the Canadian Medical Association offer higher coverage limits for mental health and addiction services.

Financial Assistance Programs Reduce Treatment Barriers

The Salvation Army operates 18 addiction treatment centers across Canada with fees that scale based on income. United Way chapters in major cities provide emergency grants that average $2,500 per person for treatment costs. Many private facilities offer payment plans with zero interest over 12-24 months. Some treatment centers work directly with Canadian insurance providers to streamline approval processes and reduce out-of-pocket expenses for residents who seek specialized care abroad (including facilities like Amity Palm Beach that serve Canadian clients). For comprehensive addiction treatment options, many Canadians explore both domestic and international facilities to find the best fit for their recovery needs.

Final Thoughts

Is drug rehab tax deductible in Canada? Yes, but the Medical Expense Tax Credit demands careful attention to CRA rules and documentation requirements. You can claim eligible treatment costs that exceed 3% of your net income or $2,479 (whichever amount proves lower). The complexity of tax regulations makes professional guidance valuable for most taxpayers.

A qualified tax advisor helps maximize your deductions while you avoid common errors that trigger CRA audits. They identify overlooked expenses and optimize your claim schedule. Tax professionals also navigate the intricate rules that govern medical expense claims across different provinces.

Financial concerns should never delay your recovery path. Provincial health coverage, private insurance, and payment plans provide additional options beyond tax deductions. We at Amity Palm Beach work with Canadian clients to explore available options for accessing quality addiction treatment.