The addiction treatment industry generates billions in annual revenue, yet many people wonder how much money do rehab centers make. Profit margins vary dramatically based on treatment models, patient demographics, and operational efficiency.

At Amity Palm Beach, we understand the financial complexities behind quality addiction treatment. This analysis breaks down the revenue streams and profitability factors that drive rehab center economics.

How Do Rehab Centers Generate Revenue?

Insurance Reimbursement Drives Primary Income

Insurance reimbursements represent the largest revenue stream for most rehab centers. The U.S. mental health and addiction treatment market was valued at $143.62 billion in 2024. Private insurance typically reimburses $300-800 per day for inpatient treatment, while outpatient programs receive $100-300 per session.

The challenge lies in complex prior authorization requirements and variable coverage limits. Centers must employ dedicated insurance specialists to maximize reimbursement rates, as improper codes can reduce payments by 15-25%. Medicare typically covers up to 100 days of inpatient rehabilitation care in skilled nursing facilities per benefit period, forcing facilities to optimize patient throughput.

Smart operators focus on in-network contracts with major insurers, as out-of-network rates typically decrease reimbursements by 30-40%. This strategy proves essential for maintaining stable cash flow and predictable revenue streams.

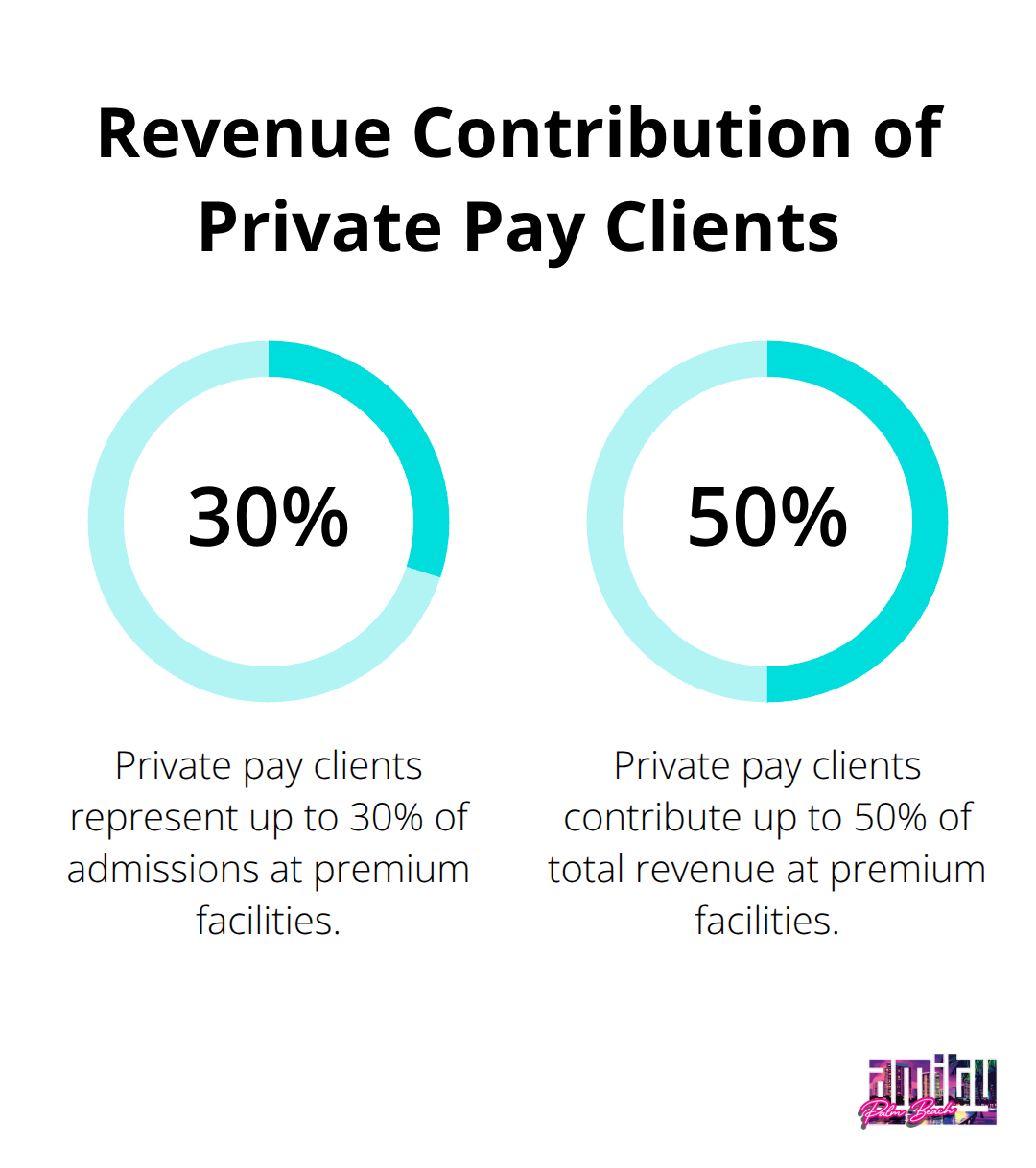

Private Pay Patients Generate Higher Margins

Self-funded patients deliver the strongest profit margins, paying $15,000-75,000 monthly for residential treatment compared to insurance reimbursement rates of $9,000-25,000. Private pay clients represent roughly 25-30% of admissions but contribute 40-50% of total revenue at premium facilities.

These patients often extend stays beyond insurance limitations, with average treatment durations reaching 60-90 days versus 28 days for insurance cases. The extended stays allow for more comprehensive treatment approaches and better long-term outcomes.

Government Funding Provides Lower Returns

Government funding through Medicaid provides lower reimbursement rates at $200-400 daily, requiring higher patient volumes to maintain profitability. State block grants and federal SAMHSA funding support specific populations but involve extensive reporting requirements and payment delays (often 60-90 days).

Successful centers balance all three revenue streams, with private pay subsidizing lower-margin insurance and government-funded patients. This diversified approach helps facilities weather changes in any single payment source while maintaining operational stability across different market conditions. Addiction treatment centers often leverage local connections to facilitate smoother transitions between different levels of care.

What Drives Rehab Center Profits

Treatment Program Types Determine Revenue Potential

Treatment program types and duration fundamentally determine profit potential. Intensive outpatient programs typically cost $250-650 per day, with full programs ranging from $3,000-10,000. The key difference lies in operational overhead and patient capacity.

Residential facilities require 24/7 staff, medical supervision, and housing costs that consume 65-70% of revenue. Outpatient programs operate with lower overhead at 40-45% of revenue, which allows higher profit margins despite lower absolute revenues. Specialized programs like executive treatment or dual diagnosis command premium rates 25-40% above standard programs.

Treatment duration directly impacts profitability through economies of scale. Longer stays spread fixed costs across more revenue days, which creates better financial outcomes for facilities.

Facility Size Creates Efficiency Advantages

Optimal facility size balances operational efficiency with quality care. Centers with 30-50 beds achieve the strongest profit margins through efficient staff ratios and resource utilization. Smaller facilities under 20 beds struggle with fixed costs, while centers that exceed 80 beds face diminished returns from bureaucratic complexity.

Capacity utilization rates above 85% maximize profitability, but rates that exceed 95% compromise care quality and increase staff burnout. The sweet spot maintains high occupancy while preserving treatment effectiveness.

Geographic Location Shapes Profit Margins

Geographic location determines both operational costs and pricing power. Urban markets like Los Angeles and New York support premium pricing but carry higher real estate and labor costs. Rural locations offer lower overhead but limited patient volume and reduced insurance reimbursement rates.

Centers must weigh these trade-offs carefully when selecting locations. Market density affects both competition levels and patient accessibility (which directly influences admission rates).

Market Competition Influences Revenue Strategies

Dense competition forces centers to differentiate through specialized services or accept lower margins. Markets with fewer than three competitors per 100,000 residents support higher pricing and better profit margins. Centers in saturated markets must invest heavily in marketing, spending 8-12% of revenue compared to 3-5% in less competitive areas.

The substance abuse treatment market projected to reach $36.83 billion by 2034 creates expansion opportunities. However, early market entry proves essential for establishing dominant positions before competition intensifies. These market dynamics directly influence how centers structure their financial performance and growth strategies.

What Are the Financial Realities of Rehab Centers

Revenue Per Patient Varies Dramatically Across Treatment Levels

Average revenue per patient spans a massive range based on treatment intensity and duration. Detox programs generate $8,000-15,000 per patient over 5-7 days, which creates daily revenues of $1,100-2,100. Residential treatment produces $45,000-180,000 per patient over 30-90 days, with luxury facilities that command $3,000-6,000 daily rates. Outpatient programs yield lower absolute numbers at $3,000-12,000 per patient over 12-24 weeks, but deliver superior profit margins due to minimal overhead costs.

The most profitable centers focus on extended residential stays with private pay clients, as these patients generate 3-4 times more revenue than insurance-funded cases. Successful operators target average length of stay between 45-60 days to maximize revenue while they maintain clinical effectiveness.

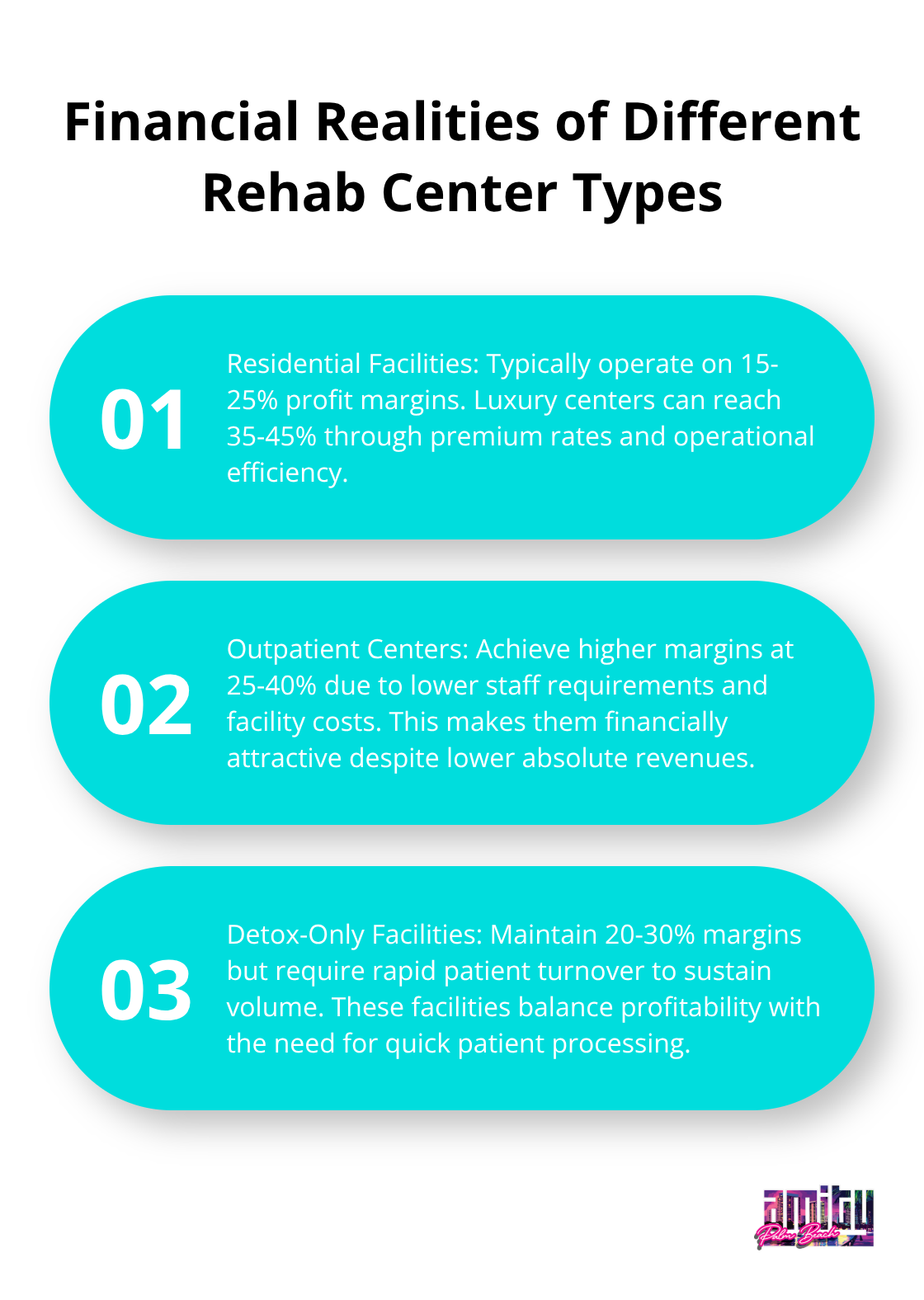

Profit Margins Split Between Facility Types

Residential facilities typically operate on 15-25% profit margins, with luxury centers that reach 35-45% through premium rates and operational efficiency. Outpatient centers achieve higher margins at 25-40% due to lower staff requirements and facility costs. Detox-only facilities maintain 20-30% margins but require rapid patient turnover to sustain volume.

The substance abuse treatment market reached $12.81 billion in 2023, with projections that hit $36.83 billion by 2034. This 10.05% annual growth rate creates expansion opportunities for well-positioned operators. However, profit margins face pressure from increased competition and regulatory compliance costs (which now consume 8-12% of revenue compared to 5-7% five years ago).

Market Growth Patterns Show Clear Winners

Centers that specialize in dual diagnosis treatment capture premium rates 30-50% above standard addiction programs, as this population requires specialized psychiatric care. MAT-integrated facilities outperform abstinence-only programs in both patient retention and revenue generation, with 25% higher completion rates that translate to better long-term financial performance.

Geographic expansion into underserved markets provides the strongest growth opportunities, as established urban markets face oversaturation with declining profit margins. Centers that accept only insurance coverage struggle with average revenues of $25,000-35,000 per patient (which forces them to maintain 90%+ occupancy rates for profitability).

Final Thoughts

The question of how much money rehab centers make reveals a complex financial landscape driven by multiple revenue streams and operational factors. Insurance reimbursements form the foundation at $300-800 daily for inpatient care, while private pay patients generate the strongest margins at $15,000-75,000 monthly. Government contracts provide stability but lower returns at $200-400 daily rates.

Profitability depends on treatment program types, facility size optimization, and geographic position. Residential centers achieve 15-25% margins, while outpatient programs reach 25-40% through lower overhead costs. The addiction treatment market’s projected growth to $36.83 billion by 2034 creates expansion opportunities for well-positioned operators (especially those who focus on specialized care).

Sustainable success requires balance between financial performance and clinical excellence. Centers that prioritize evidence-based treatment, maintain appropriate staff ratios, and focus on patient outcomes build stronger reputations and referral networks. We at Amity Palm Beach demonstrate that quality treatment drives the most reliable revenue growth through comprehensive care approaches.