The rehabilitation industry generates billions in annual revenue, yet many wonder: are rehab centers profitable? The answer depends on complex financial factors ranging from insurance reimbursements to operational costs.

At Amity Palm Beach, we understand that profitability directly impacts treatment quality and accessibility. This analysis examines the real economics behind addiction treatment facilities.

How Do Rehab Centers Generate Revenue?

Rehabilitation centers operate through three primary revenue channels that determine their financial viability. Insurance reimbursements form a significant portion of most facilities’ income, with private insurance paying substantial amounts per person. However, these payments often arrive at negotiated rates below standard pricing, which forces centers to carefully manage their patient mix.

Insurance Reimbursements Form the Foundation

Medicare and Medicaid reimbursements provide lower rates but offer volume stability for treatment facilities. Private insurance delivers higher per-patient revenue but requires extensive prior authorization processes that can delay admissions. Centers must navigate complex billing procedures and maintain detailed documentation to secure these payments. The approval process often takes 3-5 business days, during which potential patients may seek treatment elsewhere.

Private Pay Clients Drive Higher Margins

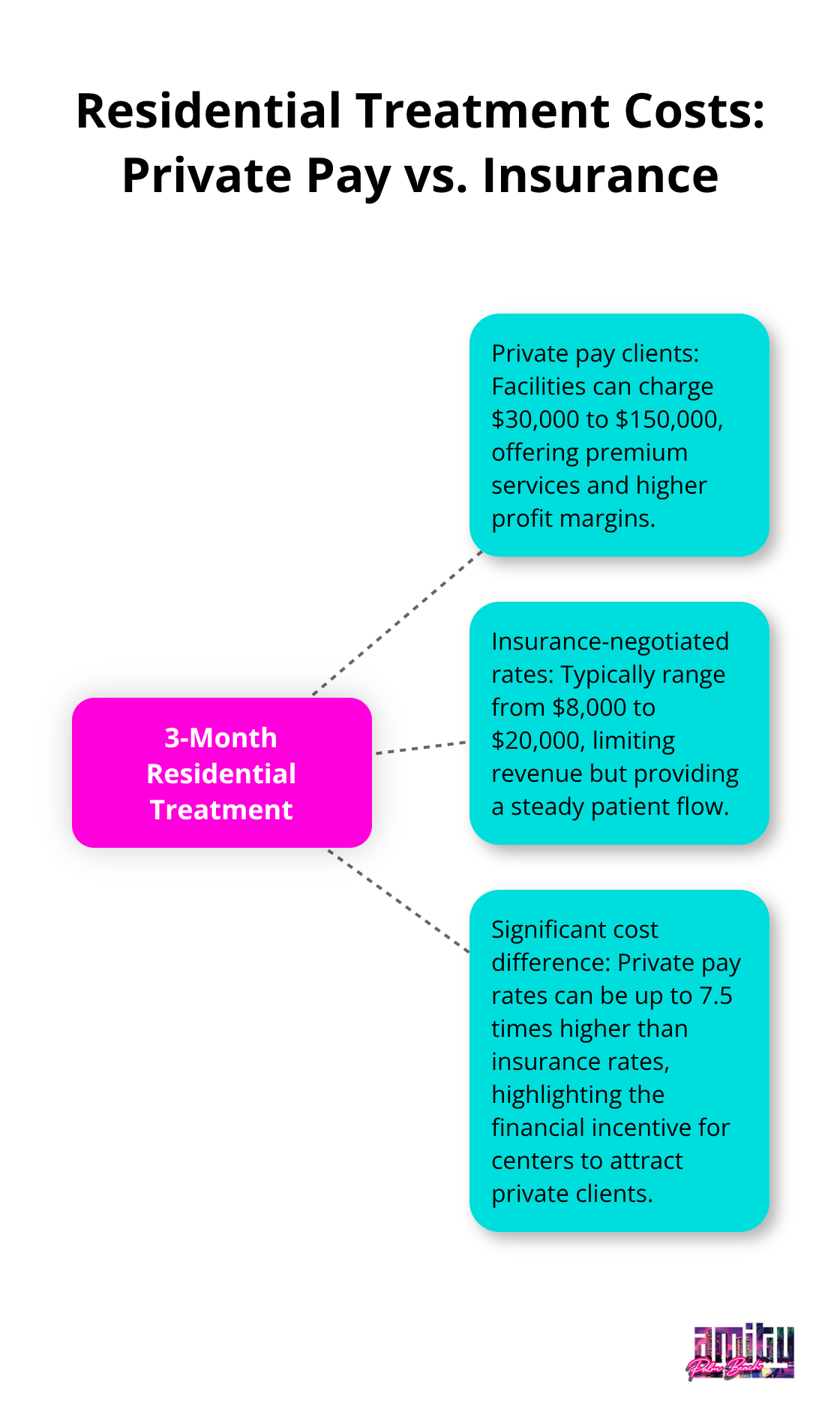

Private pay patients represent the most profitable segment for rehabilitation facilities. These clients pay full rates without insurance company negotiations and often choose premium services that command higher fees. Cash-based programs can charge $30,000 to $150,000 for three-month residential stays, compared to insurance-negotiated rates of $8,000 to $20,000 for similar services.

Successful centers actively market to affluent demographics and offer luxury amenities to attract private pay clients. The North American drug rehab market shows strong demand for premium treatment options. Private pay clients also complete treatment at higher rates, which improves facility outcomes and reputation.

Government Funding Provides Stability But Limited Growth

Federal and state grants offer operational stability but rarely support significant expansion. SAMHSA block grants and state funding typically cover basic services for underserved populations, with reimbursement rates 30-50% below private insurance levels. These contracts require extensive documentation and compliance measures that increase administrative costs.

Centers that rely heavily on public funding struggle to invest in facility improvements or advanced treatment technologies. However, government contracts do provide predictable revenue streams that help facilities maintain baseline operations. Understanding how these different revenue streams interact becomes essential when examining the key factors that affect overall profitability in addiction treatment.

What Drives Rehab Center Operating Costs?

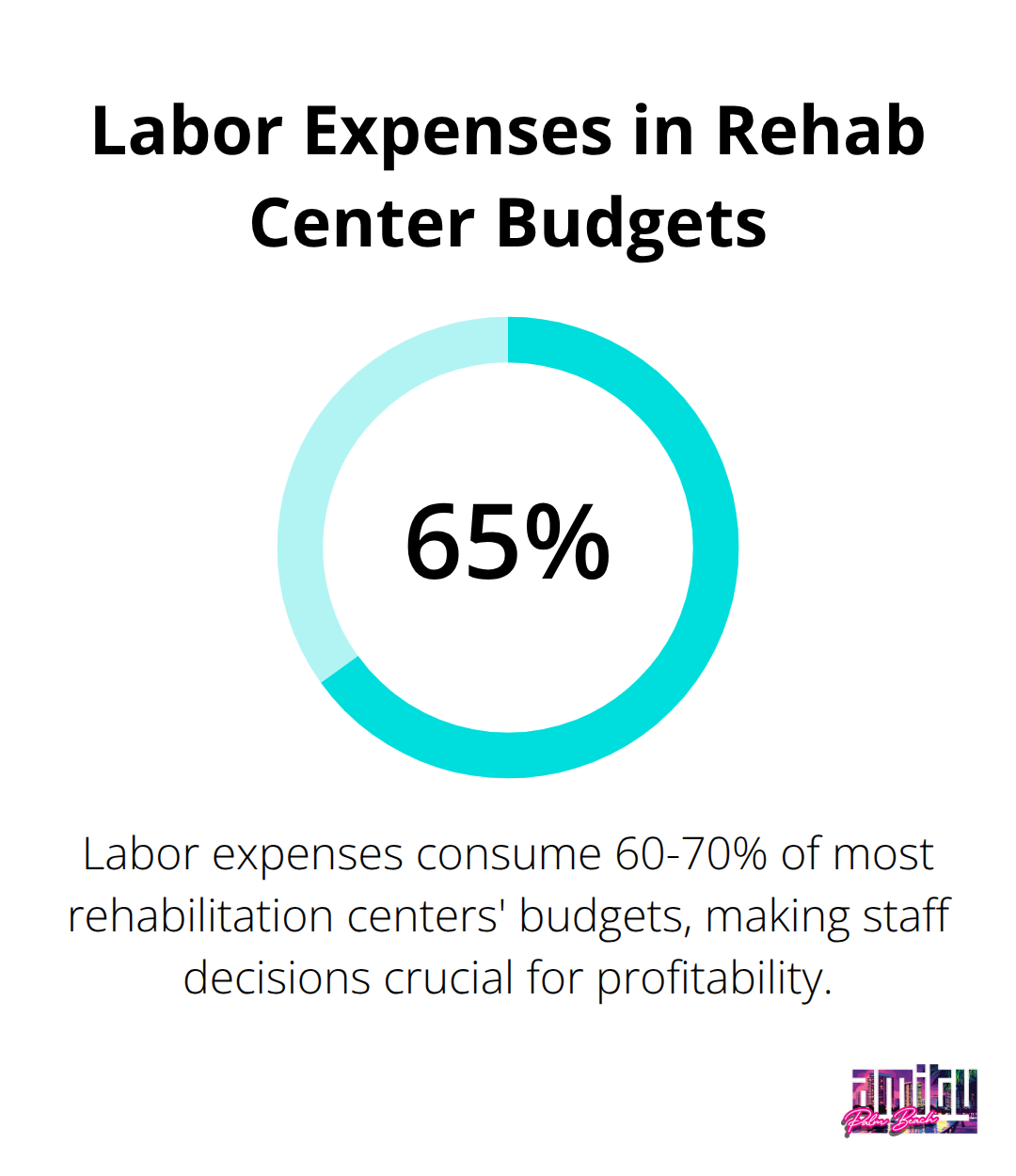

Labor expenses consume 60-70% of most rehabilitation centers’ budgets, which makes staff decisions the single largest factor in profitability. Facilities must maintain specific staff-to-patient ratios that state licensing requirements mandate, with facilities generally required to deliver at least 3.5 hours of nursing care per patient each day. Licensed psychiatrists command salaries that exceed $200,000 annually, while addiction counselors earn $40,000-$60,000 per year. Centers that skimp on qualified staff face higher turnover rates, which cost approximately $15,000 per replacement hire (according to healthcare industry data).

Staff Ratios Determine Service Quality and Revenue

Premium facilities maintain ratios of one staff member per three patients, which allows for individualized treatment plans that justify higher fees. Budget-conscious centers often operate at minimum regulatory requirements, which limits their ability to charge premium rates. Medical directors and clinical supervisors represent fixed costs regardless of census levels, so patient capacity utilization becomes critical for profitability. Successful centers optimize schedules to maintain 85-90% occupancy rates while they meet staffing requirements.

Facility Costs Impact Long-Term Sustainability

Real estate and utilities typically account for 15-20% of operational budgets, with coastal locations that command higher rents but attract affluent clientele. Equipment costs range from $2,000-$4,000 monthly for basic medical supplies, while advanced treatment technologies require additional investment. Insurance premiums for malpractice coverage average $25,000-$40,000 annually per facility. Luxury centers in premium locations often justify higher overhead through increased private pay rates and operational efficiency.

Treatment Outcomes Drive Referral Revenue

Facilities with documented success rates above 70% generate significantly more referral business from healthcare providers and alumni networks. Poor outcomes result in negative online reviews that can reduce admissions by 25-30% within six months. Centers that invest in evidence-based treatments and outcome tracking systems command higher reimbursement rates from insurance providers. Quality metrics directly correlate with long-term profitability through reduced marketing costs and increased patient retention rates.

These operational realities create significant financial pressures that many rehabilitation centers struggle to manage, particularly when combined with external market forces and regulatory challenges. For those seeking comprehensive addiction treatment, understanding these cost factors helps explain the investment required for quality care.

Financial Challenges and Market Realities

Healthcare costs continue to rise, forcing rehabilitation centers to absorb higher expenses for medical supplies, equipment, and pharmaceuticals while insurance reimbursement rates remain flat or decline. Regulatory compliance costs now consume 8-12% of operational budgets, with facilities that spend $150,000-$300,000 annually on licenses, accreditation, and documentation requirements.

Compliance Costs Strain Facility Budgets

The Joint Commission accreditation alone costs $45,000-$75,000 per facility every three years, plus additional expenses for compliance monitors. Centers must also invest heavily in electronic health record systems that cost $30,000-$100,000 annually to maintain regulatory standards. These escalated compliance costs disproportionately impact smaller facilities, which lack economies of scale to spread administrative expenses across larger patient volumes.

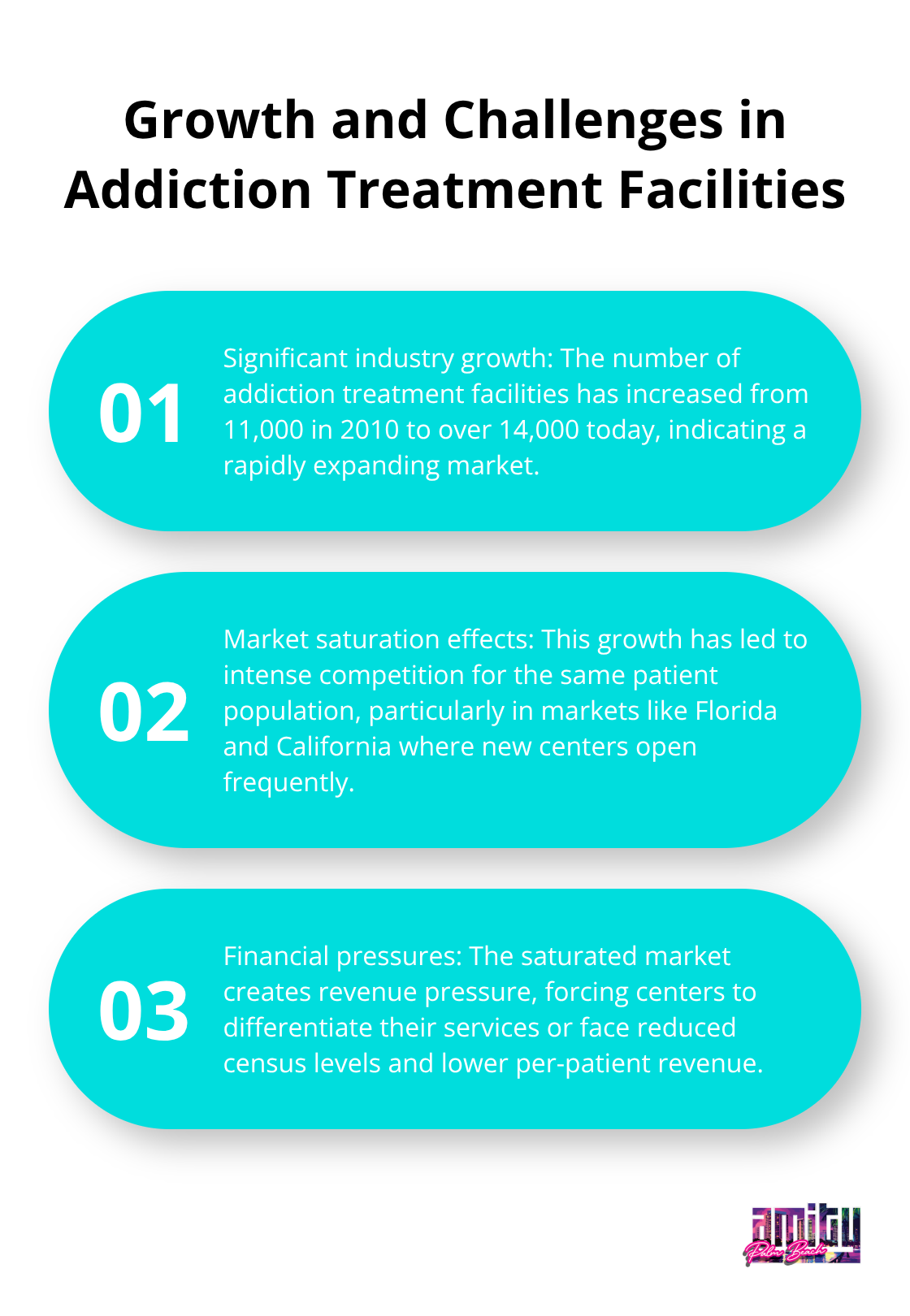

Market Saturation Creates Revenue Pressure

The number of addiction treatment facilities has grown from 11,000 in 2010 to over 14,000 today, which creates intense competition for the same patient population. This saturation particularly affects markets like Florida and California, where new centers open monthly while patient demand remains relatively stable. Private equity investment has accelerated facility expansion, with 127 mergers and acquisitions that occurred in 2021 alone (according to behavioral health industry reports).

Insurance Delays Impact Patient Flow

Insurance approval delays now average 7-14 days compared to 3-5 days in previous years, during which potential patients often choose other facilities or abandon treatment altogether. Centers that cannot differentiate their services through specialized programs or superior outcomes face reduced census levels and lower per-patient revenue. Substance abuse often results in job loss and financial instability, making patients more sensitive to treatment delays. Successful facilities invest $50,000-$100,000 annually in digital marketing and search engine optimization to maintain visibility in increasingly crowded markets.

Final Thoughts

Are rehab centers profitable? The evidence shows mixed results across the industry. Facilities that maintain 85-90% occupancy rates with balanced revenue streams achieve strong profitability, while those that rely solely on government funding struggle financially. The global substance abuse treatment market’s projected growth to $36.83 billion by 2034 indicates opportunities exist, yet operational costs and regulatory compliance expenses consume portions of facility budgets.

Private pay clients remain the most profitable segment, with premium facilities that charge $30,000-$150,000 for residential treatment. Market saturation and insurance approval delays create challenges that force centers to differentiate through specialized programs and superior outcomes. Quality care must remain the primary focus rather than pure profit motives (facilities that prioritize evidence-based treatment generate better outcomes and drive referral business).

Centers that invest in qualified staff and maintain high treatment standards build reputations based on genuine recovery results rather than cost-cutting measures that compromise patient care. We at Amity Palm Beach combine clinical excellence with personalized care to create positive patient outcomes and operational success. The most profitable centers focus on addiction treatment quality rather than shortcuts that damage long-term sustainability.